how to pay indiana state taxes quarterly

You can find your amount due and pay online using the intimedoringov electronic payment system. How do I pay my Indiana state taxes by phone.

Dor Keep An Eye Out For Estimated Tax Payments

For example you can pay Indiana property taxes in person online by phone or mail at participating banks and even by text.

. Completing Form ES-40 and mailing it with your payment. Refer to the INTIME User Guide for Individual Income Tax Customers for more information. File online using IN Tax.

The rules that determine who can make quarterly estimated tax payments for the calendar year 2022 are. The best way to. Employers engaged in a trade or business who pay compensation Form 9465.

See Departmental Notice 2 for more information Increase in Gasoline License Tax and Special Fuel License Tax. This means you may need to make two estimated tax payments each quarter. Some states also require estimated quarterly taxes.

This penalty is equal to 005 of your tax due every month that it remains unpaid. Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax. That means taxes are due when you earn the income not when your tax return is due.

How to Pay Quarterly Taxes So if you discover youre required to pay quarterly taxes you must first use Schedule C of Form 1040 to determine how much you owe. Your tax projection exceeds 1000 after removing withholding and tax credits during tax return filing. Form WH-3 Annual Withholding Tax return is to be filed each year by February 28.

The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME and via Electronic Funds Transfer EFT. The option to make an estimated payment will appear in the Payment type drop-down. Review your payment and select Submit.

Complete the contribution report that. Withholding and tax credit will not be less than. While that might not seem like much it can add up quickly.

Select Individual Payment Type and select Next. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest version of Form ES-40 fully updated for tax year 2021. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Pay online quickly and easily using your checking or savings account bankACHno fees or your debitcredit card fees apply through INTIME DORs e-services portal. More information is available in. Employers Quarterly Federal Tax Return Form W-2.

More information is available in the Electronic Payment Guide. Once logged-in go to the Summary tab and locate the Make a payment hyperlink in the Account panel. 90 of the quarterly estimated tax for the year 2022.

Form UC-1 Quarterly Contribution Report is due the last day of the month following the end of the quarter April 30 July 31 October 31 and January 31 for unemployment taxes. If you dont pay in throughout the year youll likely get hit with an underpayment penalty. Under Quick Links select Make a Payment.

File online using IN Tax. If youre self-employed you need to pay federal estimated quarterly taxes for the income you make. Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax.

You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. Completing Form ES-40 and mailing it with your payment. The Indiana Department of Revenue and county treasury offices offer state residents more than one way to pay their taxes.

However if your net earnings equate to less than 5000 you may be able to file a Schedule C-EZ instead. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app. Youll be redirected to InTime or the Indiana Taxpayer Information Management Engine.

One to the IRS and one to your state. Choose the amount you want to pay and your payment method and select Next. Click on Make Payment or Establish Payment Plan in the navigation bar.

Here are your payment options. Visit IRSgovpayments to view all the options. Estimated payments may also be made online through Indianas INTIME website.

Scroll down and navigate to Make a Payment in the Payments section. QuickBooks Self-Employed calculates federal estimated quarterly taxes. Our tax system is based on a pay-as-you-go rule.

Depending on the amount of tax you owe you might have. For additional information refer to Publication 505 Tax Withholding and Estimated Tax. Enter your SSN or ITIN and phone number choose the type of tax payment you want to make and select Next.

You can also arrange for an Indiana state tax payment plan. Effective August 1 2022 the gasoline use tax rate in Indiana for the period from August 1 2022August 31 2022 is 0294 per gallon. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME and via Electronic Funds Transfer EFT.

You can find your amount due and pay online using the intimedoringov electronic payment system. You do not need to create an INTIME logon to make a payment.

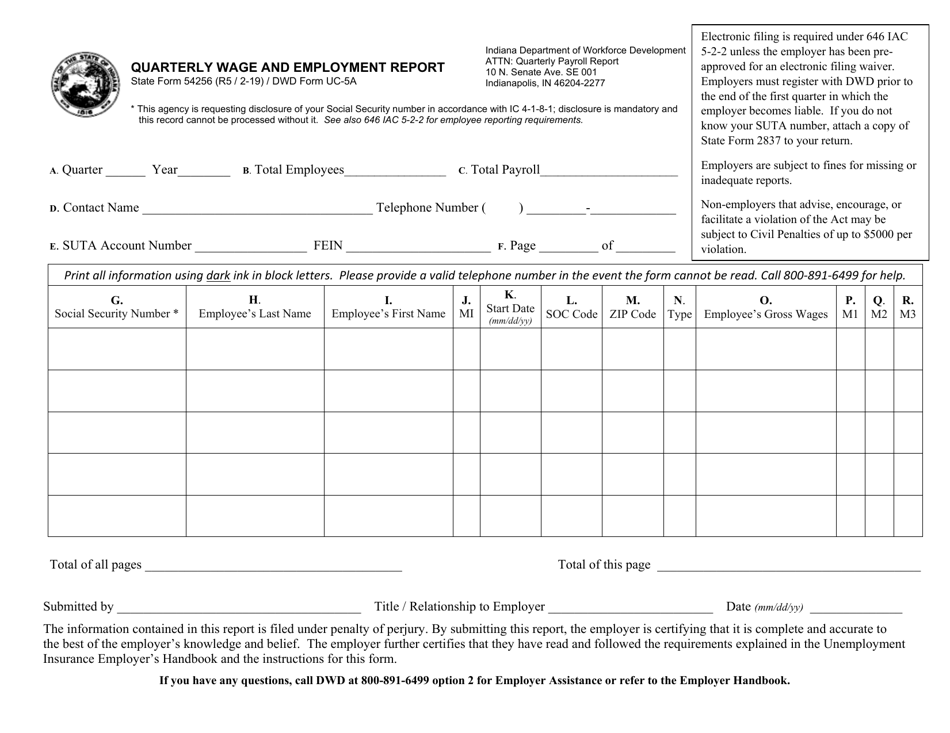

Indiana Quarterly Wage And Employment Report Fill Online Printable Fillable Blank Pdffiller

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Indiana Taxes For New Employees Asap Payroll Services

.png)

Quarterly Tax Calculator Calculate Estimated Taxes

Dwd Form Uc 5a State Form 54256 Download Printable Pdf Or Fill Online Quarterly Wage And Employment Report Indiana Templateroller

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

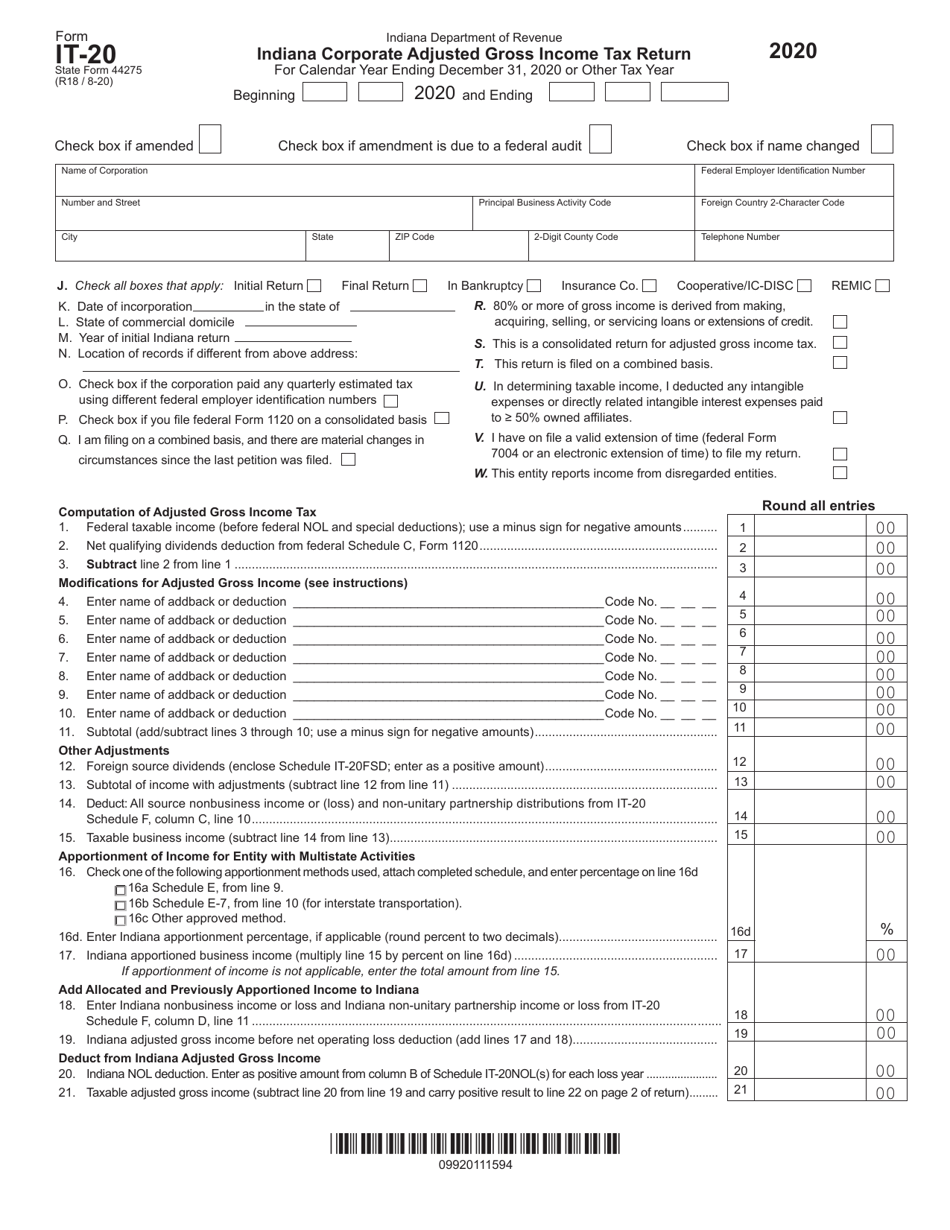

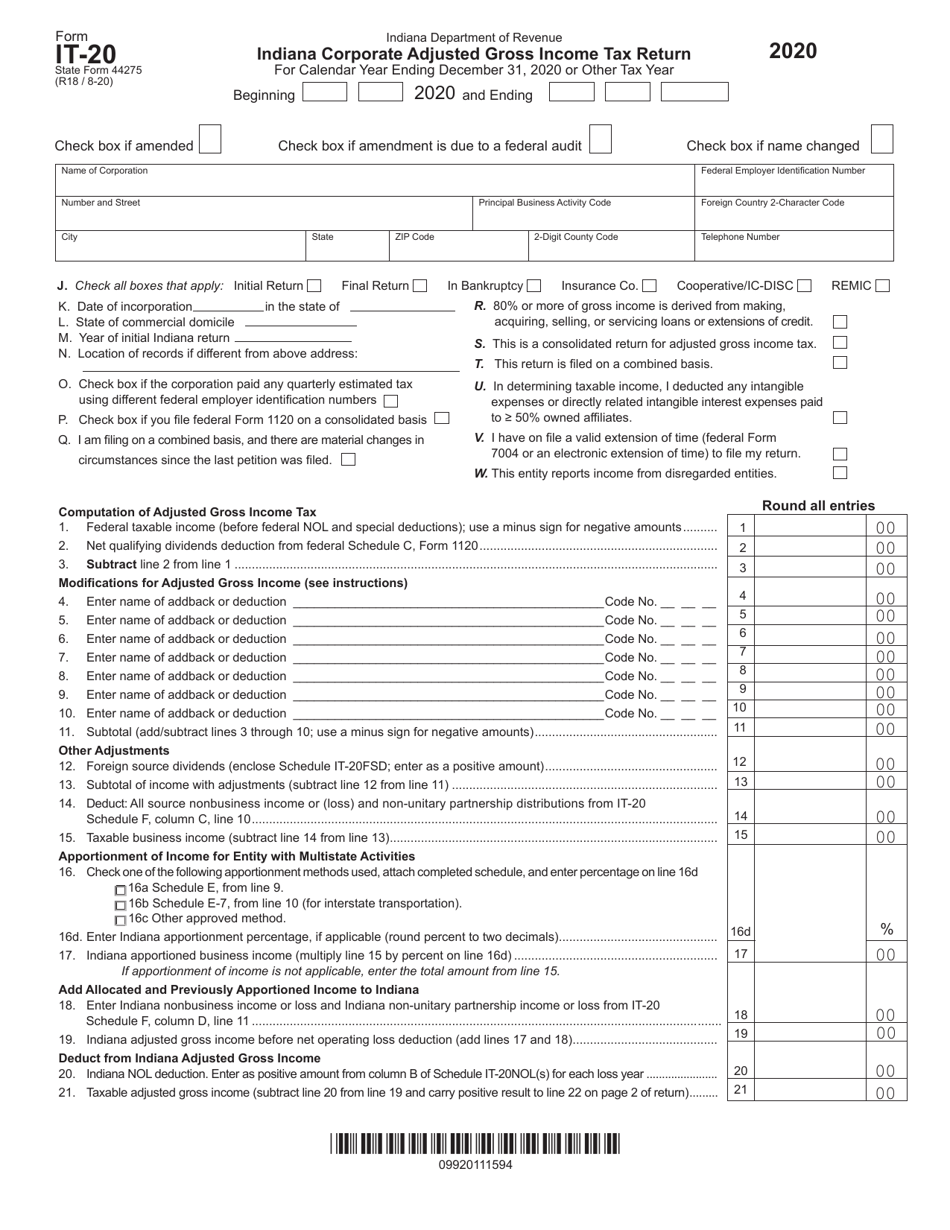

Form It 20 State Form 44275 Download Fillable Pdf Or Fill Online Indiana Corporate Adjusted Gross Income Tax Return 2020 Indiana Templateroller

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help

![]()

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Indiana Estimated Tax Payment Form 2021 Fill Online Printable Fillable Blank Pdffiller

Dor Make Estimated Tax Payments Electronically

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Dor Ready To Pay Your Quarterly Estimated Taxes Intime Can Help